Streamline refinance calculator

Learn about Interfirsts 0-origination-fee mortgages. How to use this mortgage repayment calculator.

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Rates may vary based on LTV credit scores or other loan amount.

. Lets take a look at a couple of times when it makes sense to take a refinance over a modification. Type in your mortgage term in years. FHA Streamline Refinance.

2550 Paseo Verde Parkway Suite 100 Henderson NV 89074 United States. I am in the mortgage industry and I dont even think I have witnessed such an easy transaction. Get Price Range.

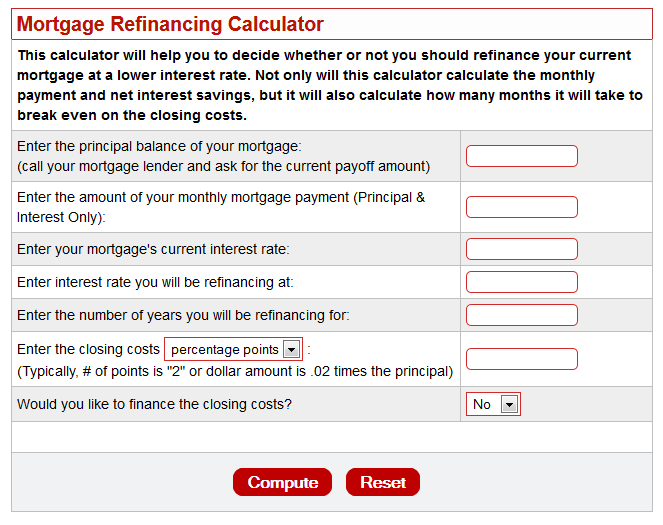

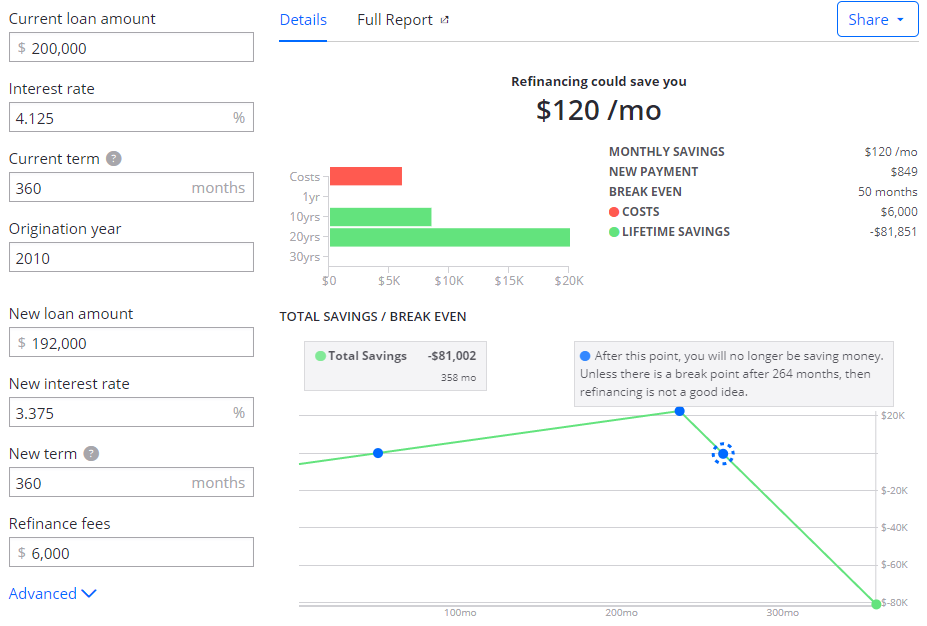

See how much how you can afford. To refinance with cash back youll need to have made at least 12 consecutive payments post-forbearance. Bankrates mortgage refinance calculator will run the numbers for your specific mortgage rate and term and give you the exact.

Two main programs help VA borrowers refinance to a lower rate -- the VA Streamline Refinance also known as the Interest Rate Reduction Refinance Loan IRRRL and the VA Cash-Out Refinance. Secure a low rate on new or used vehicles and apply online today. 5625 6338 APR with 1375 discount points on a 60-day lock period for a 15-Year VA Cash-Out refinance and 6250 6595 APR with 0375 discount points on a 60-day lock period for a 30-Year VA Cash Out refinance.

Use PenFed Credit Unions auto loan calculator to determine your monthly car payment. Toggle Navigation 800 251-9080. Make your offer stronger with a pre-qual letter.

Contact our licensed Mortgage Loan Officers today to see how big your monthly savings could be. Enter how much you want to borrow under Loan amount. You want to take cash out of your home equity.

The pros cons and benefits to borrowers. An FHA refinance loan is a refinance insured by the Federal Housing Association. Some borrowers using the FHA Streamline Refinance may qualify with fewer than three payments.

Literally the quickest refinance ever. Check our rates and lock in your rate. Contact multiple lenders and inquire about rates fees and lender qualification criteria.

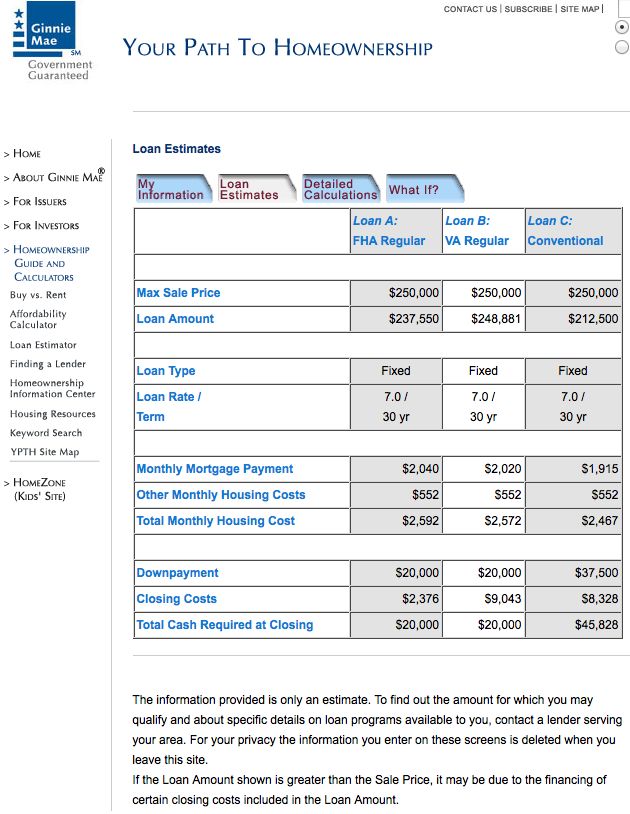

Services not available with Streamline Basic include cheque books overdrawing or formal overdraft facilities. If you request it each lender can provide you with a Loan Estimate which includes the terms of the loan projected payments if you were to take out the loan and a summary of loan costs and fees. You can compare the Loan Estimate from multiple lenders to.

Compare FHA refinance rates. As of September 15 2022 the fixed Annual Percentage Rate APR of 614 is available for 15-year first position home equity installment loans 50000 to 200000 with loan-to-value LTV of 70 or less. Shop and apply for refinance loans.

Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022 Down payment assistance programs in every state for 2022 August 2. These Refinance loan rates assume a loan-to-value ratio lower than 90. Youre not underwater on your loan.

We will definitely use them for all of our mortgage needs. Learn more about how we calculate affordability below. Though there are special refinance programs that can help you adjust the terms of an underwater loan refinancing is much easier when you have equity.

If you switch to a Streamline Basic account from another CommBank account which allows cheque book access and youve been using that facility to access your account we may permit you to continue using your cheque book to access your. To get started call 1-800-884-5560 or start your VA Refinance quote online. An FHA streamline refinance is a faster way to refinance from one FHA loan to another with less paperwork because it doesnt require an appraisal.

A streamline refinance is a product for government-backed loans. Select the Funding Fee Select fee 000 050 100 125 140 165 230 360. The FHA Streamline Refinance is Village Capitals expertise.

Our calculator uses information from you about your income monthly expenses and loan term to calculate an estimate of what you may be able to afford. The VA loan affordability calculator is set to the top end of the VAs recommended DTI ratio of 41 percent. Homeowners who refinance can wind up paying more over time because of fees and closing costs a longer loan term or a higher interest rate that is tied to a no-cost mortgage.

If you currently have one or more VA loans and looking to refinance one of them use this calculator to see if you will need a down payment or if your sufficient equity. Use our mortgage refinance calculator to find out if refinancing could help you save money reduce your mortgage payments or take cash out of your home.

Mortgage Refinance Calculator Excel Spreadsheet Refinance Mortgage Mortgage Refinance Calculator Refinance Loans

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Fha Streamline Refinance Rates Requirements For 2022

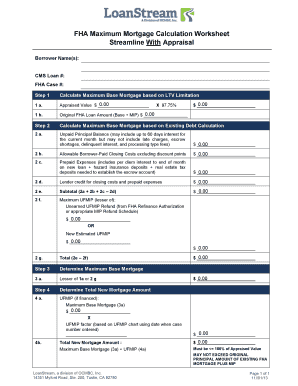

Fha Streamline Refinance Calculator Fill Online Printable Fillable Blank Pdffiller

Mortgage Refinance Analysis Calculator Amerimutual Brokers

Fha Loan Calculators

Fha Loans How Can I Estimate My Monthly Mortgage Payment

Fha Streamline Refinance Rates Requirements For 2022

Va Mortgage Calculator Calculate Va Loan Payments

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

How Does Refinancing Work How And When To Refi Zillow

Fha Loan Calculators

Fha Refinance Calculator Village Capital Investment

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Should I Refinance My Mortgage Refinance Calculator Dcu

22 Printable Mortgage Refinance Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller