Remaining mortgage calculator with extra payments

The actual amount will still depend on your affordability. If you have made any extra payments you can find the period remaining by clicking here and entering your current balance rate and monthly payment.

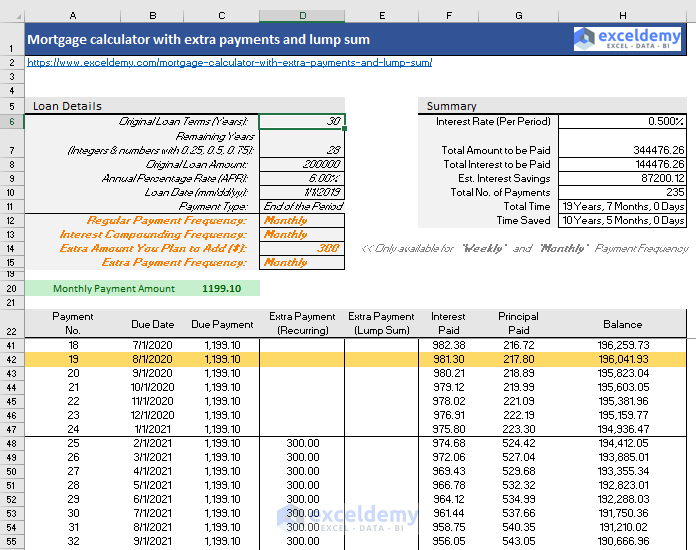

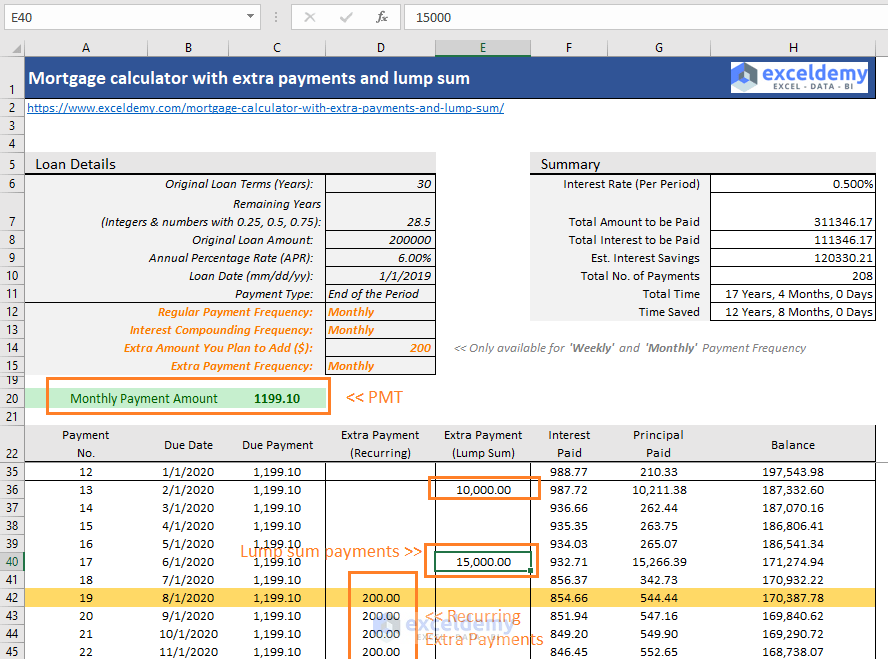

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

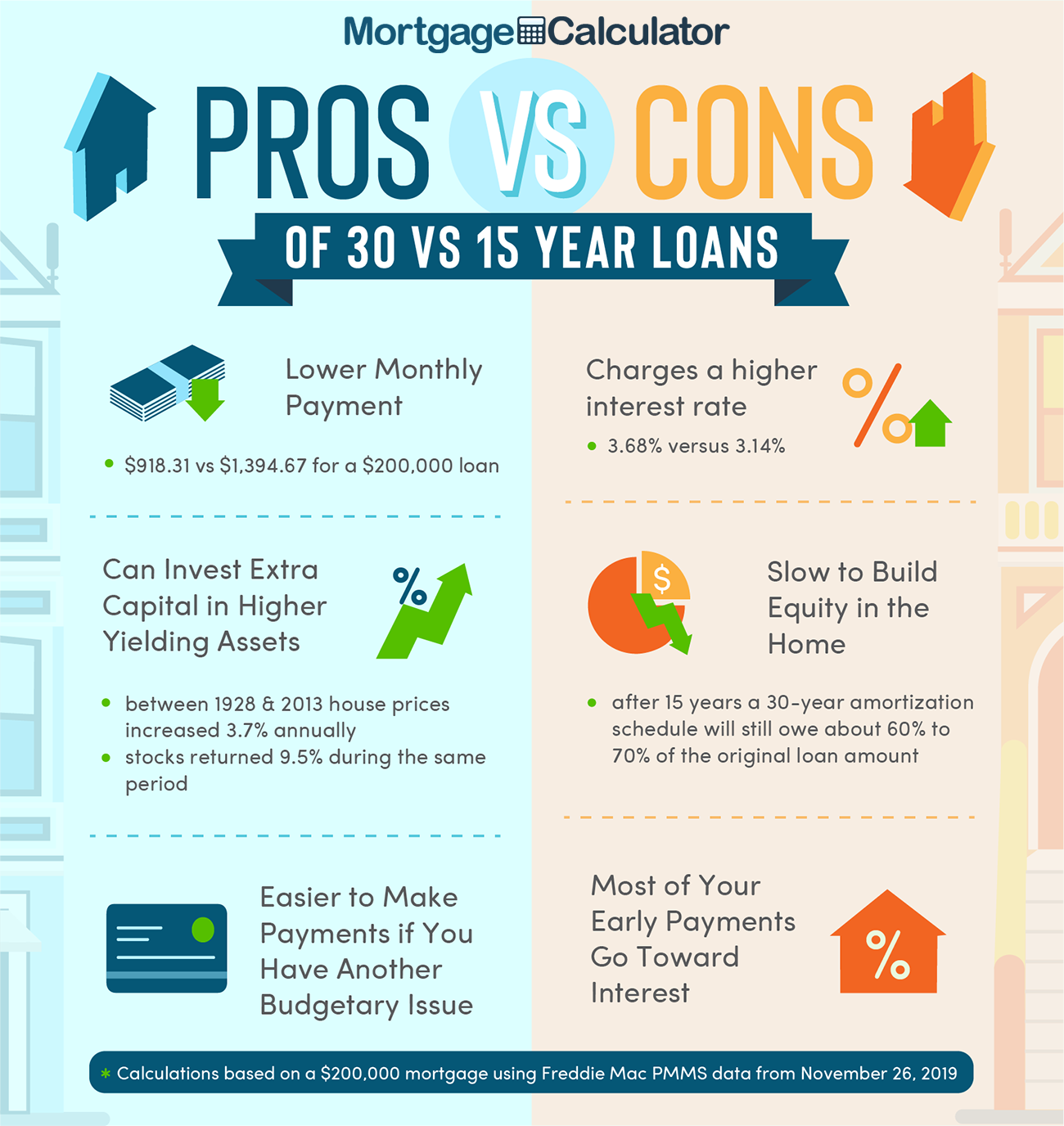

Try the mortgage calculator to find out how much you can expect to pay on a 15-year mortgage compared to a current 30-year mortgage.

. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Mortgage Payoff Calculator 2a Extra Monthly Payments. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage.

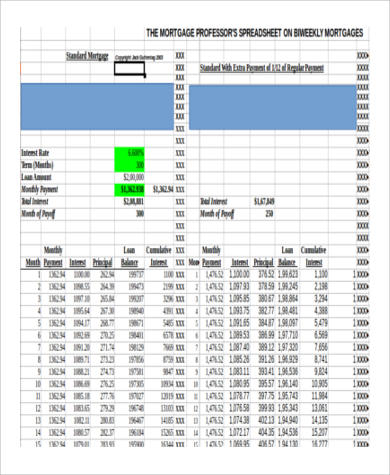

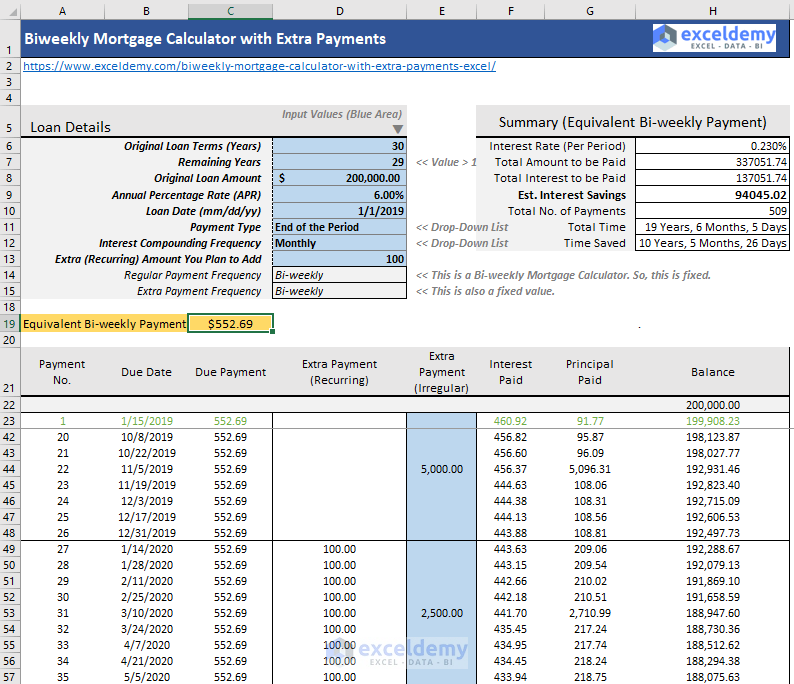

Make more frequent payments. Make sure the payment is principal and interest only. This bi-weekly pattern is distinct from a bimonthly mortgage payment which may or may not involve extra payments.

Extra payments count even after 5 or 7 years into the loan term. Mortgage Payoff Calculator 2a Extra Monthly Payments. Here are the advantages of making extra mortgage payments.

See which type of mortgage is right for you and how much house you can afford. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Mortgage Amount or current balance.

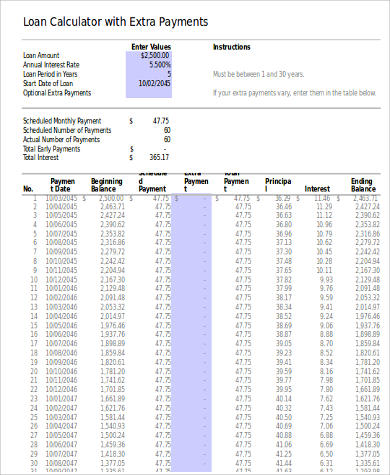

Borrowers who want an amortization schedule. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Whatever the frequency your future self will thank you.

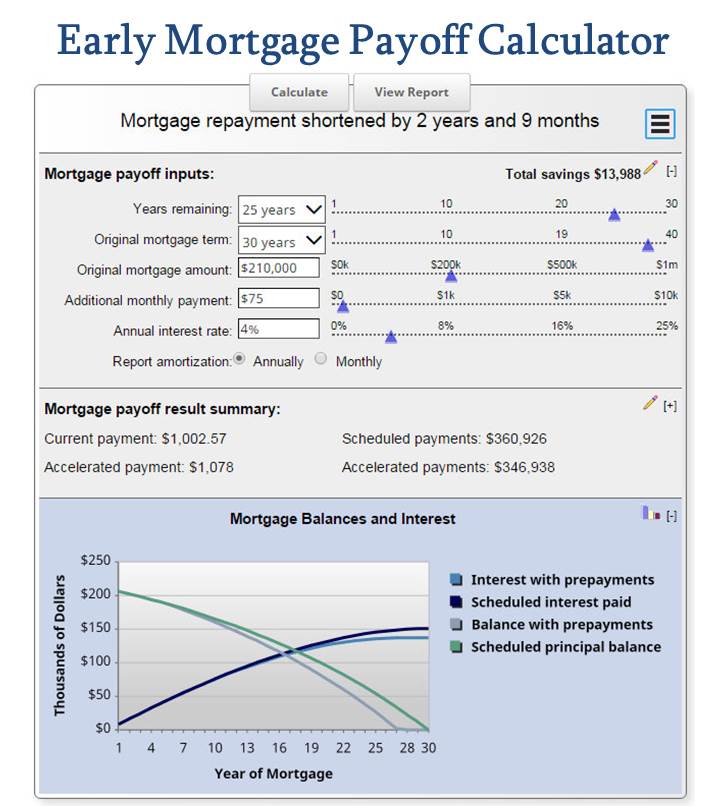

Ultimately significant principal reduction cuts years off your mortgage term. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether.

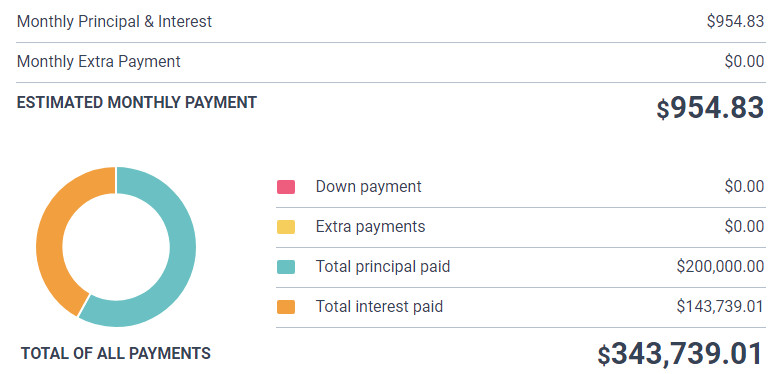

There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. With regular monthly payments your mortgage balance is paid down at a slow pace.

Use this calculator if the term length of the remaining loan is known and there is information on the original loan good for new loans or. In addition to making extra payments another great way to save money is to lock-in historically low interest rates. Use our extra mortgage payment calculator to see how fast you can pay off your mortgage with additional monthly payments.

It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Another technique is to make mortgage payments every two weeks. It would take years before the mortgage amount you borrowed is diminished significantly especially if you took a large capital.

If you have made any extra payments you can find the period remaining by clicking here and entering your current balance rate and monthly payment. Use our free budgeting tool EveryDollar to see how extra mortgage payments fit into your budget. Borrowers who want an amortization schedule.

Making biweekly mortgage payments is a strategy that can help you save a lot of money in interest and pay off your mortgage early. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. To calculate mortgage payments mortgage loan amount annual interest rate mortgage length and loan start date fields are required.

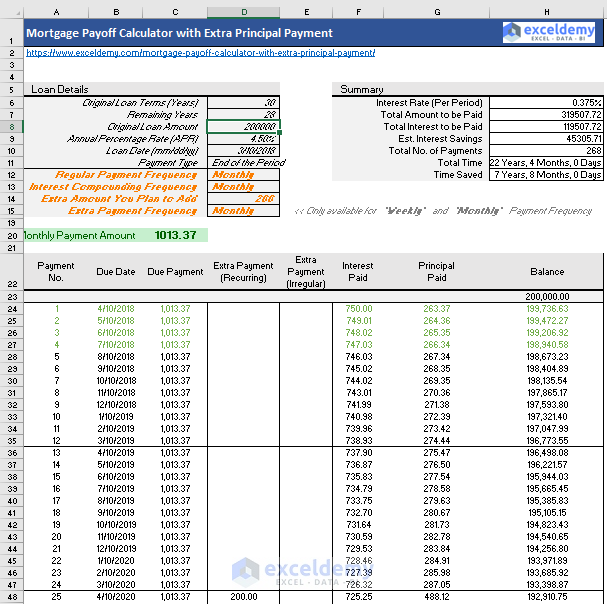

Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. Making extra payments can drastically reduce your loan term and save you a tremendous amount on interest charges. Use our free mortgage calculator to easily estimate your monthly payment.

Or make a one time lump sum payment. Biweekly paymentsThe borrower pays half the monthly payment every two weeks. Lets say you have a 220000 30-year mortgage with a 4 interest rate.

Note that this not an official estimate. Make sure the payment is principal and interest only. If You Know the Remaining Loan Term.

Building a Safety Buffer by Making Extra Payments. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. In the example above an additional 100 per month took 15 years off a 30-year mortgage.

Is approaching 400000 and interest rates are hovering around 3. If the first few years have passed its still better to keep making extra payments. Calculate Different Scenarios.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Reduce Your Mortgage Balance Faster. Connect with our friends at Clever Real Estate for a local agents expert opinion and a free.

Make Extra House Payments. In that case you can use our extra payment mortgage calculator which has options to. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

You have a remaining balance of 350000 on your current. Instead of making one payment every month youll be making a payment every other week. This mortgage amortization calculator with extra payments calculates your monthly payment generates the amortization table and allows to add lump sum payments and recurring payments to your calculations.

Who This Calculator is For. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Today 15-year mortgage payments are comparable to 30-year mortgage payments at the higher interest rates.

Who This Calculator is For.

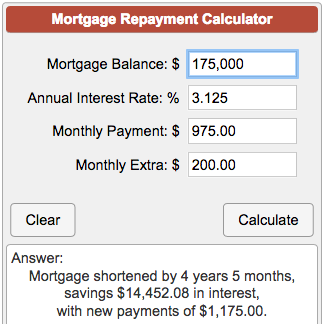

Mortgage Repayment Calculator

Biweekly Mortgage Calculator

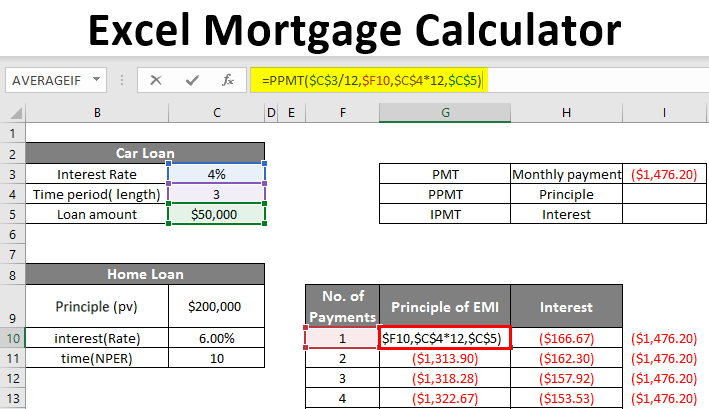

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Extra Payment Mortgage Calculator For Excel

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Line Of Credit

Mortgage With Extra Payments Calculator

Extra Payment Calculator Is It The Right Thing To Do

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Free Interest Only Loan Calculator For Excel

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template